florida mortgage rates refinance guide for homeowners

Thinking about refinancing in Florida? Understanding how lenders price rates-and how your profile fits-can reduce your monthly payment and total interest. Rates move with market yields, but your credit score, equity, and loan type still drive the offer you see. In a hurricane-prone state, insurers and taxes can influence your debt-to-income, so plan for them.

Frequently asked questions

- What affects my rate? Credit, loan-to-value, property type, occupancy, points, and loan size all matter.

- Fixed or ARM for Florida? A fixed loan adds stability; ARMs can be cheaper upfront if you expect to move before adjustments.

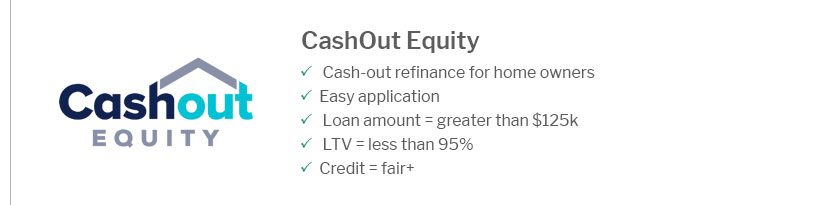

- Cash-out vs rate-and-term? Cash-out tends to price higher; take only what supports your goals.

- How do points work? Paying points lowers the rate; confirm your break-even timeline before buying them.

- What about closing costs? Compare lender fees, title, and prepaid escrows; no-cost options usually trade a slightly higher rate.

Smart preparation

Shop at least three lenders on the same day, request a written Loan Estimate, lock only after verifying the term, and consider a float-down option if available. Gather pay stubs, W-2s, insurance, and tax bills to avoid delays.